ev charger tax credit 2022

Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. After the base 2500 the tax credit adds 417 for a 5-kilowatt-hour battery.

Plant Engineering Considering Electric Vehicle Charging Risks

Electric vehicle EV buyers were able to claim a 7500.

. The federal government offers tax incentives for businesses to install Level two and three EV chargers. Note that the federal EV tax credit amount is affected by your tax liability. In addition to local incentives the.

Heres a summary of electric vehicle incentives by state. Individual owners of qualified electric vehicles can get a grant of up to 75 capped at 350 inc. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000.

ClipperCreek began building home and commercial chargers at its factory in Auburn California in 2009 and its HCS-40 Level 2 home station is one of the best-selling. Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric cars. Get More Power Than Ever With a Nissan Electric Car.

Between July 1 2021 and June 30 2022 the rebate may cover 40 of the costs of acquiring and installing qualified EVSE or up to the following amounts. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The tax credit covers 30 of a companys costs.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. For example if you apply for a rebate in 2022 your vehicle model year must be from 2014 to 2020. Feel The Pure Rush Of Powerful Performance With Electric Motors Designed And Built By BMW.

Charging station and a 250 rebate for the installation of a dedicated EV meter. The minimum federal PEV tax credit is 2500 but could be as much as 7500 depending in the PEVs battery capacity weight and one other key factor well discuss in a. The amount of the credit will vary depending on the capacity of the.

Taxpayers may receive up to 7500 as a federal tax credit for electric cars in 2022. 19 hours agoThe tax credit was established in 2010 to help get plug-in vehicles onto showroom floors and into consumers garages. The research team estimates that on average the federal government could have saved 2 billion or 1440 per electric vehicle sold.

VAT of the total purchase and installation expenses of one EV charger. Batteries For a Range Of Lifestyles. Ad Drive Into A Better Future With BMWs Exhilarating All-Electric Vehicles.

Illinois Electric Vehicle Rebate Program begins July 1 2022. How much is the US federal tax credit for EV chargers. It covers 30 of the costs with a.

The incentives had been proposed to. In this blog we will discuss what the credit is how it works and more. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

The renewal of an EV tax credit for Tesla provides new opportunities for growth. Find Your 2021 Nissan Now. Ad Build Price Locate a Dealer in Your Area.

For every kilowatt-hour of capacity above 5 kilowatt-hours the credit goes up by 417 capping out. The incentive can be a large percentage of the charger and installation. The Federal EV Charger Tax Credit program offers a rebate of 1000 per site.

The 30D a credit is claimed on Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit Including Qualified Two- or Three-Wheeled Plug-in Electric Vehicles PDF. The Federal Goverment has a tax credit for installing residential EV chargers. FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED.

Ad Drive Into A Better Future With BMWs Exhilarating All-Electric Vehicles. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021. We are financial advisors. For residential installations the.

Thats a huge difference in valuation. Jan 13 2022 Thread starter 1 The federal government offers a tax credit for EV charger hardware and EV charger installation costs. Feel The Pure Rush Of Powerful Performance With Electric Motors Designed And Built By BMW.

For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of. This incentive covers 30 of. Illinois residents that purchase a new or used all-electric vehicle from an Illinois licensed dealer will be eligible for a.

Ev Charging Stations For Dealerships Enel X

Do I Have To Pay To Charge My Electric Car Autotrader

Delta Ev Charger 30 Amp 25ft Charging Station

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

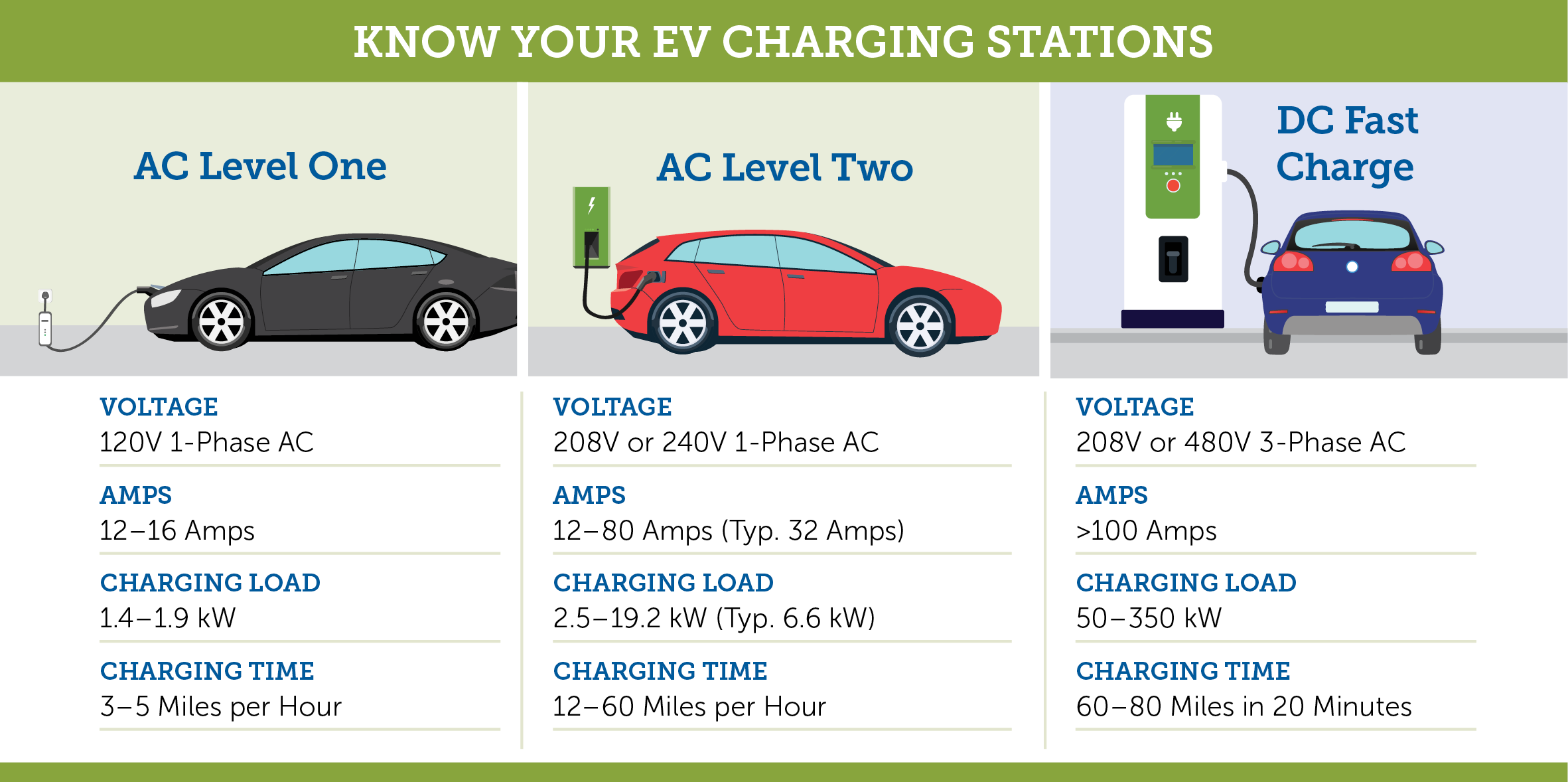

What Are The Ev Charger Levels

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

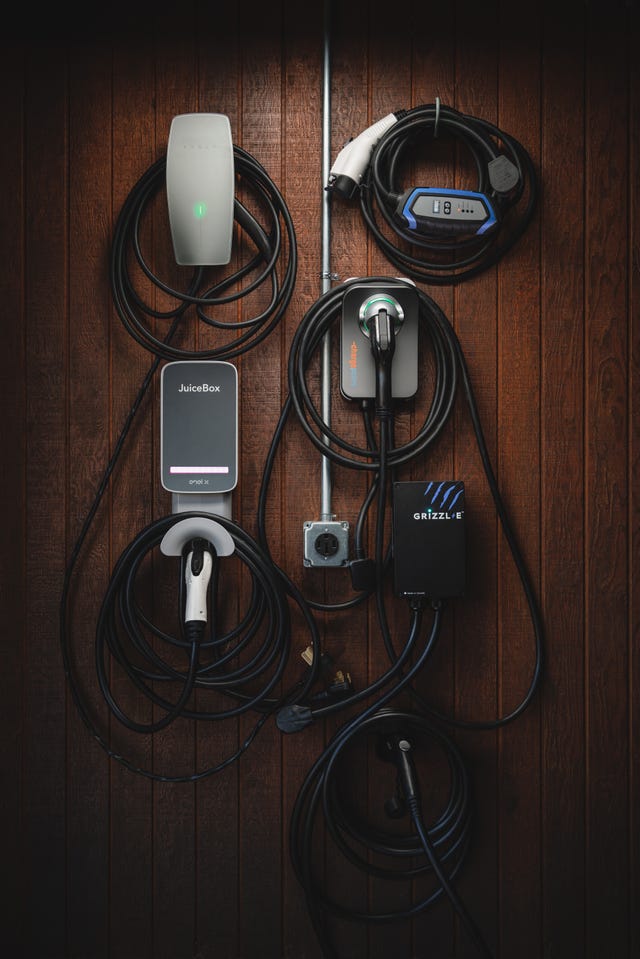

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

Tax Credit For Electric Vehicle Chargers Enel X

Commercial Ev Charging Incentives In 2022 Revision Energy

Best Ev Chargers For 2022 Tested Car And Driver

2022 Ev Charging Incentives For New England Revision Energy

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

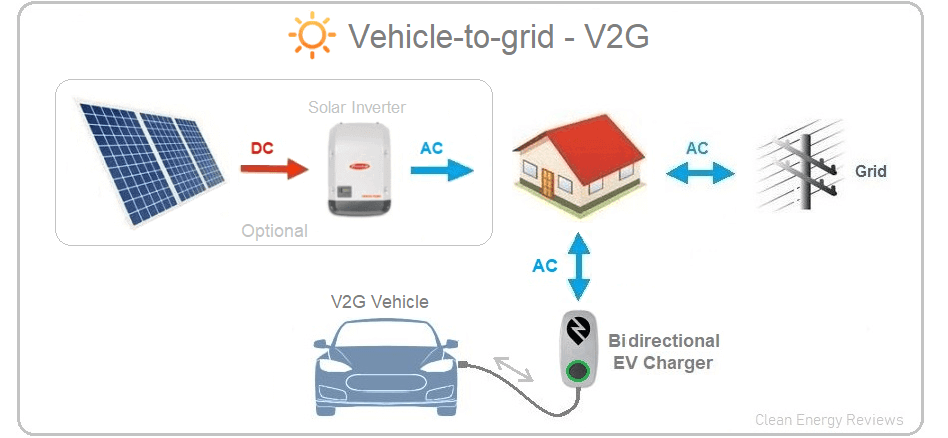

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

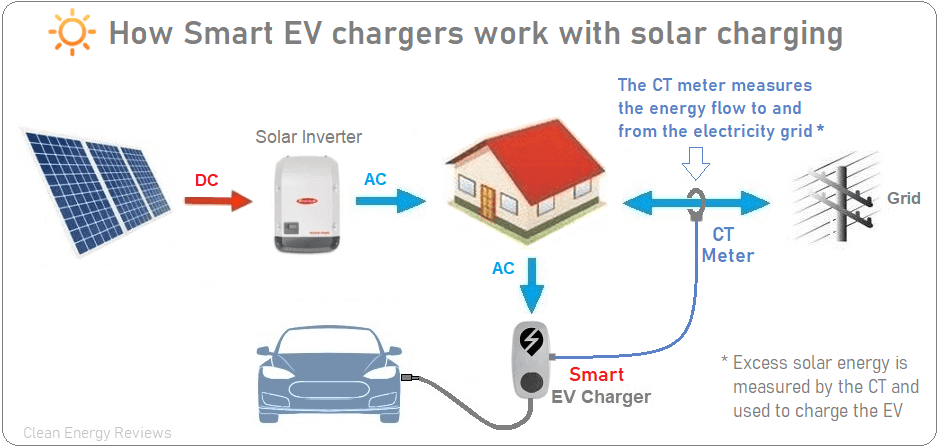

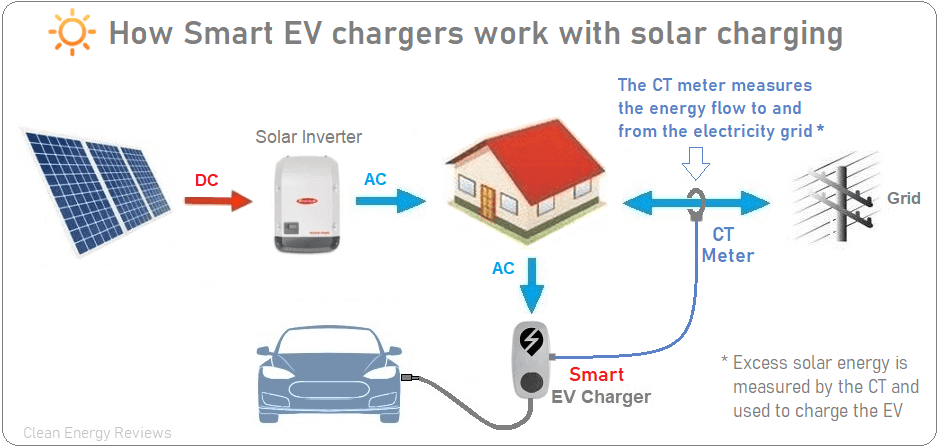

Best Smart Electric Vehicle Chargers Clean Energy Reviews

Wallbox Pulsar Plus Ev Charger 699

About Electric Vehicle Charging Efficiency Maine

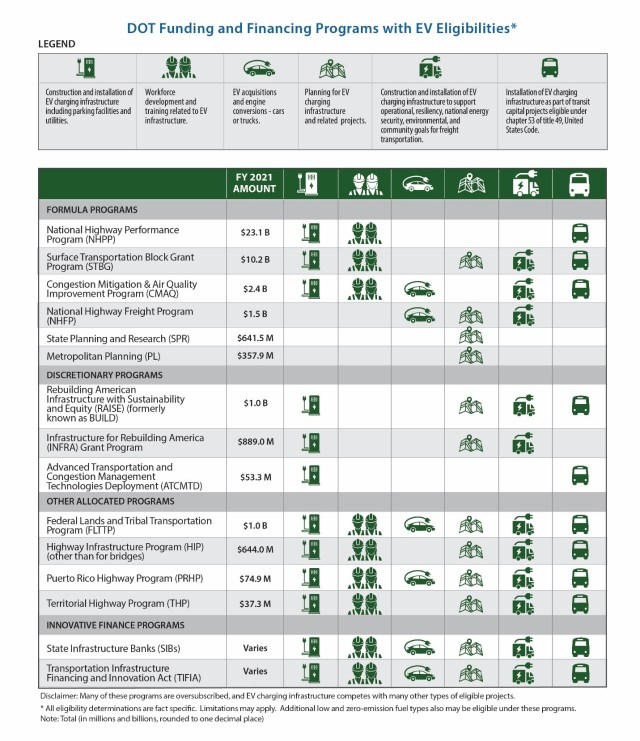

Fact Sheet Biden Administration Advances Electric Vehicle Charging Infrastructure The White House

Find Charging Options For Your Electric Vehicle Carolina Country